Resolution Criteria

This market will resolve YES if the total mana earned from unique trader bonuses, minus the 100 liquidity paid up front, and minus any mana returned from the pool upon resolution (and other sources adding/subtracting from the bottlm line) exceeds the total mana profit in the identical 1,000 liquidity market at resolution time.

The market will resolve NO if equal or less mana is earned in the 100 liquidity market.

Considerations

The outcome will depend on both markets' resolution and the completion of final mana calculations.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ43 | |

| 2 | Ṁ29 | |

| 3 | Ṁ22 | |

| 4 | Ṁ18 | |

| 5 | Ṁ18 |

Stats

Total volume Ṁ1,719

Traders 16

Views 126

Trader bonuses 160

Liquidity return 10

- Cost Ṁ100

~~~~~~~~~~~~~~~~~

= Ṁ70 gain

In comparison, the 1k liquidity twin market ran a Ṁ730 loss

@traders Updated the description to include any mana returned from the liquidity pool upon resolution, as well as any other bonuses/cashbacks that might adjust the bottom line.

Approximately the same number of people should bet on both markets (due to the fact that people who see one market will likely see the other); therefore the 1k liquidity market, with its higher cost, should make less money.

@GazDownright Does the cost to create the market count?

Edit: Nvm it probably does. I just saw a comment by the creator that says "These markets are about the total return/loss on investment"

@GazDownright I think the generally (invocing Cunningham's Law) only apply if there are few or no trades or if a result that was'nt heavily bet on was the resolution.

@GazDownright Click on the market info, and you can see! The pool shifts based on the current probability, and you'll get back the shares in the pool when you resolve the market.

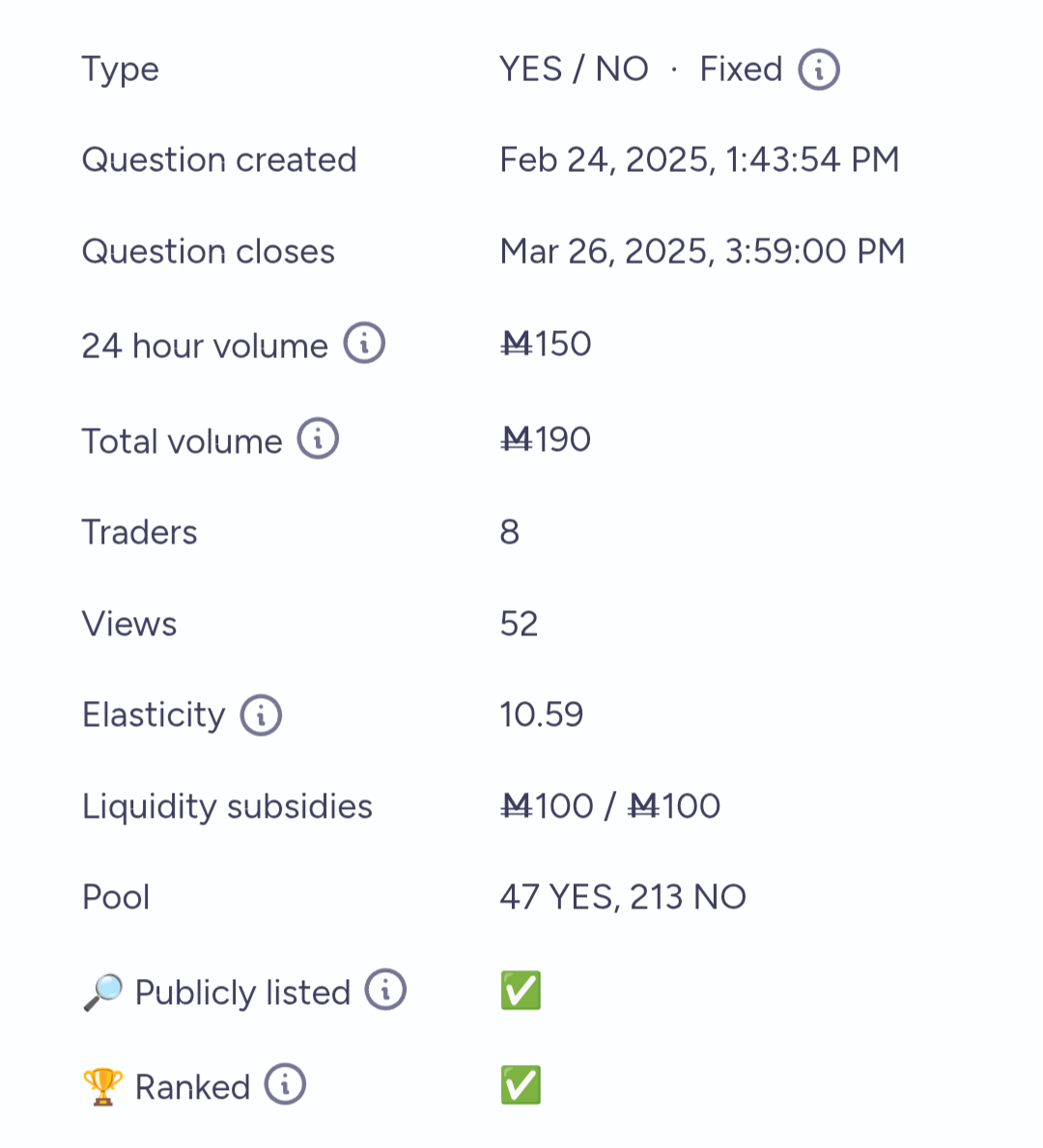

If you resolved YES right now, you would get back 47 mana:

@TimothyJohnson5c16 okay thanks fornthis important detail.

This means I'll have to include this for the resolution criteria. These markets are about the total return/loss on investment.

If there are other factors that effects the bottom line i'll have to add those too.

@TimothyJohnson5c16 correct me if I am wrong but the idea is to incentivice markets that catch black swans

@JussiVilleHeiskanen I'm not the best person to explain it, but I think it comes from how the math for the liquidity pool is defined. Each trade is executed against the pool by exchanging shares (unless there's a limit order to trade against).