https://archive.is/cbWiA - "SpaceX Tender Offer Said to Value Company at Record $210 Billion"

https://www.cnbc.com/2024/12/11/spacex-valuation-surges-to-350-billion-as-company-buys-back-stock.html - "SpaceX valuation surges to $350 billion as company buys back stock"

Question resolves as YES if before December 12th 2025, there is a Bloomberg article that reports a SpaceX private tender sale, or post money VC investment valuation, or public valuation of more than $450B.

Update 2025-12-05 (PST) (AI summary of creator comment): All qualifying valuations must be reported in a Bloomberg article, regardless of whether they are from an IPO, VC investment, or private sale. The "or public valuation" clause in the original description also requires a Bloomberg article to count.

Update 2025-12-10 (PST) (AI summary of creator comment): Plans or announcements of an IPO do not count - the IPO must actually occur and be reported in a Bloomberg article for the market to resolve YES. The creator has clarified that even though SpaceX announced plans for a 2026 IPO targeting a $1.5 trillion valuation, this does not meet the resolution criteria because the IPO has not yet happened.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ1,021 | |

| 2 | Ṁ130 | |

| 3 | Ṁ86 | |

| 4 | Ṁ69 | |

| 5 | Ṁ59 |

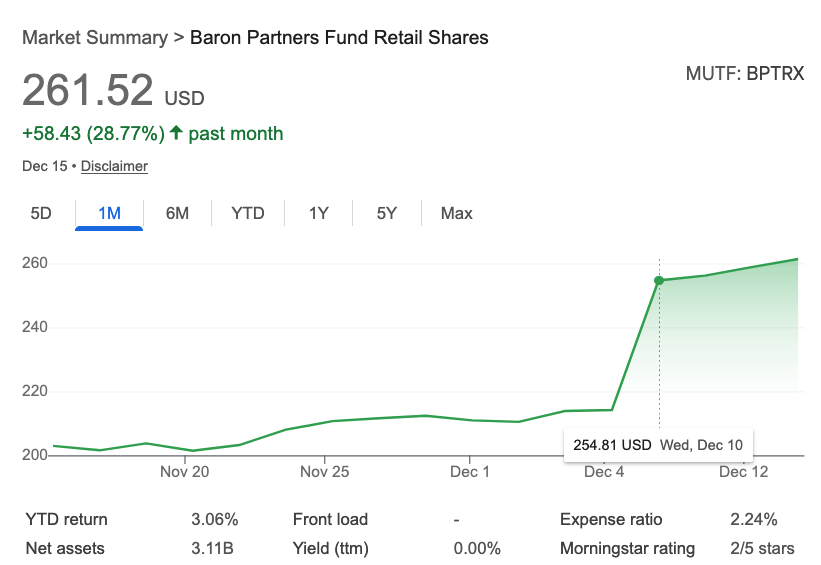

Bloomberg provides quotes, prices, and performance data for the mutual fund ticker BPTRX (Baron Partners Fund Retail Shares).

Bloomberg hosts a dedicated public quote page at: https://www.bloomberg.com/quote/BPTRX:US

This page includes current and historical pricing (NAV), performance charts (intraday, historical, comparisons), technical analysis, trend lines, and related fund details.

The primary Ron Baron-managed mutual funds that hold shares in SpaceX (a private company) are:

Baron Partners Fund (tickers: BPTRX or similar institutional shares) — This fund has the largest exposure, with SpaceX typically representing 11-18% of its assets (e.g., around 15% as of late 2024/early 2025 reports). It's often the second-largest holding after Tesla.

Baron Focused Growth Fund (tickers: BFGFX/BFGIX) — SpaceX is frequently the largest or a top holding here, with allocations around 10-11% of net assets.

By Dec 10 public valuation had changed for the SpaceX shares tradable within BPTRX

@brianwang @admin Bloomberg billionaire list adjusted Elon musk net worth yesterday to $638 billion. This is a Bloomberg adjustment of spacex valuation on Dec 15. Ron baron fund was a public repricing based upon insider knowledge rhat $800 billion valuations had occurred with auditable results by Dec 12

@brianwang Dec 12 is not within a year of Dec 11 2024 the creation date of this market. Thou it is before the Dec 15th close date.

@ChristopherRandles A December 10, 2025 Bloomberg TV segment mentioned the "tender is confirmed" at $800 billion/$421 per share

@brianwang Tender is confirmed might mean it is going to happen rather than has happened, However, yes, the valuation change on the 10th does look like it had happened by then and looks like the resolution should be changed.

BTW, What is the source for the 5th to 12th period?

@ChristopherRandles I have personal connections in the SPV market. I know it was probably happening based upon conversations. This is however just my own hearsay. But Also Logic - whales and institutions were bidding up the Ron Baron funds proxy with SpaceX in it from Dec 5-10. Were they seeing the private deal offers at the tender and then turning around and buying on the public market as well. Were they front running on the known WSJ likely rumor or did they load up more and more knowing it was confirmed. however this is academic as the public repricing happened. Billions were committed to move those prices. Were they committing on a sure thing because it was known? That answer is not required for this question but we know what happened as the end result now. Were they super predictors and able to make high conviction investments of that scale or did they have confirmed knowledge. You know how markets move here with play-manna. It was almost fully priced in by Dec 10. The collective conviction can be reversed based upon the implied $800 billion at 90+% by Dec 10

@brianwang by Dec 10 here this market was at 52%. Mana predictions here were diverged from the actual public money valuation. Were the big money people that much better at being willing to predict on the public information available or did they have confirmed information that was not fully public. Why were they going all in with the Dec 5 WSJ report and then the Dec 10 Bloomberg. People here were seeing the the top of the icebergs. What can be inferred about the below the water line based upon implied price and implied probabilities.

Tough one since some articles slipped in right after the market's threshold. Gotta be NO by the criteria tho (Mod Resolved)

There is a bloomberg article:

SpaceX is moving ahead with plans for an initial public offering ... targeting a valuation of about $1.5 trillion for the entire company

https://archive.is/20251210071825/https://www.bloomberg.com/news/articles/2025-12-09/spacex-said-to-pursue-2026-ipo-raising-far-above-30-billion

However, this has not happened yet. Plans for an IPO =/= IPO. Even though it seems obvious to me that the private value of spacex is >450b, the market conditions have not yet been fulfilled.

@PeterBuyukliev https://www.bloomberg.com/news/articles/2025-12-13/spacex-sets-insider-share-deal-at-about-800-billion-valuation This just occurred, but it is on Dec 12th

@SolarFlare

"SpaceX is moving forward with an insider share sale that values Elon Musk’s rocket and satellite maker at about $800 billion

...

The per-share price of $421 in its latest secondary offering, laid out by Chief Financial Officer Bret Johnsen in the memo to shareholders, is nearly double the $212 a share set in July at a $400 billion valuation.

...

The company does tender offers twice a year, giving shareholders including employees the chance to cash in or buy more shares. In this case, SpaceX has set its fair market valuation in a precursor to an IPO next year."

In case anyone else is struggling with paywalls

https://archive.ph/20251213031942/https://www.bloomberg.com/news/articles/2025-12-13/spacex-sets-insider-share-deal-at-about-800-billion-valuation#selection-1615.0-1619.29

Note:

"Moving ahead" does not mean it has happened yet, and probably indicates it hasn't happened yet.

6 months on from July would be ~January 2026? This is obviously very vague about precisely when it will happen.

Note that question was created Dec 11th 2024 so the 1 year is up before this article dated 13th December. So, at least potentially, neither the Bloomberg article nor the insider share sale were in time. The way I understand creator comments is that both need to be before the 1 year deadline. Whether the one year deadline is Dec 11th with Dec 15 close date allowing some time for details to emerge or whether close date of Dec 15th is the one year deadline is not really entirely clear to me.

@creator this should resolve as yes.

https://finance.yahoo.com/news/spacex-offer-insider-shares-record-185117449.html

@MRME

"The details, discussed by SpaceX’s board of directors on Thursday at its Starbase hub in Texas, could change based on interest from insider sellers and buyers or other factors, said some of the people."

Not finalised yet would be my guess from that. Might not complete by year end?

@MRME this doesn't seem like a completed sale, nor a Bloomberg article

Though it does seem more and more likely that this market will resolve "yes"

The new valuation puts OpenAI ahead of SpaceX, which is reportedly valued at $456 billion, with other notable companies including ByteDance at $220 billion and Anthropic at $183 billion.

https://www.linkedin.com/posts/analytics-india-magazine_openai-has-reached-a-new-milestone-crossing-activity-7379779887311589376-52g4

@PeterBuyukliev

I am not clear on the "or public valuation of more than $450B", does that still have to be in Bloomberg article or does the 'or' make it a different separate case and what is needed for it to count as a public valuation?

@ChristopherRandles to clarify: there has to be a Bloomberg article on (ipo, or VC, or private sale)

Basically my thinking is that not any random rumour will get it's article; whilst if it happens for real, it will definitely get a Bloomberg article.

@PeterBuyukliev

Will this count?

https://forgeglobal.com/spacex_stock/

Forge price on 7 Nov 2025 $227.01

Forge Price valuation $429.48B

But on 6 Aug 2025 price was $250.21 so $429.48B/227.01*250.21 = $473.37B