Our protagonist, Euclid, has devised a scheme to beat the house in Math World Las Vegas:

He bets a dollar, double-or-nothing with even odds, on red in roulette. If he wins, great, he's done. If he loses, he doubles his previous bet and repeats until he wins, which with probability 1 he eventually will.

According to the Wikipedia page on Martingale betting, even though each bet has zero expected value, Euclid is certain to make money with this strategy. But what about his expected winnings? Are those still zero?

Argument for NO: He either makes $1 off the bat or he loses some number of times first. If he loses $1, loses $2, loses $4, then finally wins $8 -- lo and behold, he's netted $1. That's true for any possible losing streak (except an infinite losing streak, which has zero probability), so he always makes $1.

Argument for YES: Euclid is making a sequence of bets, each of which has zero expected value. The sum of any number of zeros is zero. (Also he has an infinitesimal chance of losing infinite money so that has to factor in.)

FAQ

1. How much money does Euclid start with?

Infinite money! Or, rather, we'll say he has unlimited credit. Any finite amount of money he wants to bet, he borrows it as needed. This is magical math world.

2. What's the house's edge?

None! Again: math world. Euclid wins each spin with exactly 50% probability.

3. What if the expected value (EV) is infinitesimally positive?

I think the EV is either zero or one but just in case, we'll count infinitesimal as zero. So that would be a YES here.

4. What if the EV is undefined or the answer is "it depends"?

We'll add clarifications until we get a meaningful EV and thus a definitive YES or NO.

5. What happens if Euclid has an infinite string of losses?

He gets a -$∞ payout! Being math world, all the infinitely many roulette spins happen instantaneously.

Resolution Criteria

Consensus in the comments. Failing that, expert consensus. Bet with caution until we've hashed out in the comments what that should mean! And be sure to ask about anything missing from the FAQ before betting.

Related Markets

The original Snake Eyes market (lots more related markets linked there as well)

Update 2025-06-17 (PST) (AI summary of creator comment): The creator has specified that resolution will depend on the mathematical treatment of the zero-probability event of infinite losses.

To reach a definitive answer, commenters should provide a rigorous justification, likely grounded in measure theory, for why this event can or cannot be ignored when calculating the expected value.

Update 2025-06-18 (PST) (AI summary of creator comment): The creator has stated that older comments can be ignored. They have endorsed a recent comment's rigorous mathematical approach, signaling that resolution will be based on a consensus built from similar high-quality arguments.

So, I was trying to steer away from questions like this (not least because a “prediction” market structure seems like a poor fit for math questions whose answer hinges on a consensus within some set of commeters and/or “experts”).

But I was also trying to sketch out a demonstration for why it has to be “NO”, but accidentally sketched out one for why it might just have to be “YES”.

This one hinges on whether the limit of a sequence of expected values is equal to the expected value of the limit of that sequence.

Let’s consider a sequence of strategies, E(n) for n >1, where Euclid uses that same Martingale strategy but quits if he didn’t win after n tries. So, for example, for n=2, Euclid may win on his first spin with probability 1/2 and quit, winning $1; lose on first spin, win on second with probability 1/4, winning $1; or lose on both and walk away with probability 1/4, losing $3.

In general, the expected winnings for strategy E(n) can be calculated as follows:

Euclid will lose all his spins and walk away with probability 1/(2^n); in this case, he will lose (2^n - 1) dollars.

Euclid will win a spin and walk away with $1 of winnings with probability (2^n - 1)/(2^n)

So, the expected value of E(n) = (2^n - 1)/(2^n) - (2^n - 1)/(2^n) = 0.

Then, the limit as n approaches infinity is also 0. Can we say then that Euclid’s strategy as described originally is E(∞), and the expected value of E(∞) is the limit of the expected values of E(n) as n approaches ∞?

—-

Also, I do think that the question “what is ∞*0” can make sense and have a sensible specific finite and non-zero answer in some cases, and the answer does hinge on “how big is that particular ∞ and what’s in it”?

I don’t think this contradicts the criterion/definition posed in the comments that "The Expected Value of a random variable is defined as the integral of that random variable with respect to probability measure”.

Consider a different example, which coincidentally is still about probability; Though improtantly, I’m not trying to draw parallels to this problem beyond just “how we think about integrals of weird things”.

There is such a thing as “mixed discrete-continuous probability distribution”, meaning that a variable has a component that is continuous probability distribution, e.g. a beta distribution; plus also some “point mass” components, e.g. we can say “but we also have a 25% chance of getting exactly 1”; We can meaningfully ask “what is the probability of getting a value in the range [0.5, 1]”; and this can meaningfully be described as “the integral of the PDF from 0.5 to 1, inclusive”. But this integral/probability, if we think of it in terms of the probability density and integrating over that to get the total probability, then the point mass has a probability density of ∞ and a “width” (for integral purposes) of 0; so if we think of the probability of that component in terms of the integral, it should be 0*∞;

Yet it has a well-defined finite probability (which is 0.25 in our case), but we only know that because we definied it as 0.25. When we don’t have a clear definition like this, that’s when arguments using limits typically come in.

—-

p.s. the bit that says “Euclid is making a sequence of bets, each of which has zero expected value. The sum of any number of zeros is zero. ” seems to be an oversimplification that is untrue. Euclid is using an informed (and deterministic) strategy to choose whether to bet or stop betting. This statement seems equivalent to saying that in thise game set-up(bet any amount on a sequence of 50-50 coin flips and stop whenever you want), any strategy would have an expected value of exactly 0. This is demonstrably not true; you can invent some truly horrible strategies that have a negative expected value, e.g. "bet $1 each time and stop when you win once"

But the statement's reasoning doesn't take any strategy information into account; it seems to assume that when Euclid bets n times, we can reason about the “expected value” of those bets by reasoning about what happens, on average, when anybody bets n times regardless of the outcome of the intermediate bets.

@yanamal Oh god. I tried to scroll down further in the comments to get a better understanding of the existing arguments. I regret getting involved after all.

@yanamal We can ignore those old comments! I think a couple people were trying to bully their way to the answer that seemed obvious to them. I hugely appreciate your comment.

@dreev Ok, great, because I’ve accidentally had some additional thoughts.

So, if we phrase the question as “What are Euclid’s expected winnings after the infinite number of roulette spins in this game have played out?”, then these are the arguments I can formulate for both sides:

“No” / not zero dollars:

We can calculate this expected value by splitting up the space of possible outcomes based on S, the number of spins Euclid participated in before quitting, and weighing the winnings in each option by the probability that the option would happen. For each finite S, Euclid’s winnings are $1.

If S is infinite (i.e. Euclid never gets a ball on red and never wins anything), then Euclid would have an infinitely negative loss, and this would happen with probability zero (which doesn’t make it impossible, since “infinitely unlikely” and “impossible” are different). We can ignore this possibility, or say that its contribution to the overall expected winnings is 0 (or some other number which does not result in zero dollar overall expected winnings), because [justification goes here].

“Yes” / zero dollars:

To reason about Euclid’s expected winnings after the game, Let’s consider Euclid’s expected winnings at any point during the game, i.e. at any time when some finite number N of roulette spins have played out. At any such time, Euclid’s expected winnings are $0, by the same argument as the one I had above (just with a slightly different framing):

There is a 1/(2^N) chance that Euclid lost on all N spins, and thus lost (2^N)-1 dollars.

There is a ((2^N)-1)/2^N chance that Euclid has already won one of his spins, stopped playing, and walked away from the table, winning $1

These two possibilities cancel each other out exactly in the expected winnings calculation.

So, the function of Euclid’s expected winnings during the game is just zero everywhere. We can then argue that it is also zero at infinity, i.e. after the game.

I think the “Yes” argument depends mostly on how exactly you define “Expected winnings after the game” - do you define it in a way that allows that last argument, which is essentially about taking the limit of the expected value as we approach the time “after the game”? I’m struggling to think of a way to define this expected value that would make it some specific number other than 0 (one could argue that it might be undefined, but we don’t want that).

So there are somewhat handwavy and unclear endings to both of the arguments (as I’ve stated them), but the “Yes” argument feels a lot less fishy to me. I think the “Yes” argument also credibly answers the question of “how to factor in the cost of that weird leftover possibility that Euclid spins forever and never wins”. It’s essentially factored in as the negative component for each expected value at finite values of N.

—-

Also, I took a look at the current Wikipedia page for Martingale betting, and it doesn't seem to outright say that the overall expected value wouldn’t be zero. It kind of hints at it, maybe, by saying things like “the martingale betting strategy is certain to make money for the gambler” - which is not super precise, but seems like a weaker claim; you could say it’s equivalent to saying “Euclid has a probability of 1 to make $1”, but the difference between “probability of 1” and “the only possible outcome” is the crux of the question here (being the same as the difference between “probability of 0” and “impossible”)

>This one hinges on whether the limit of a sequence of expected values is equal to the expected value of the limit of that sequence.

Yep, exactly this. Remember "Expected Value" is an integral. It's the same question as if integrals interchange with limits. The answer is "not always". One classic example is

f_n(x) = n if x < 1/n

0 otherwise

on the interval (0, 1) (or the interval [0,1], it makes no difference). The integral of f_n is 1 for all n, but the integral of the limit is 0.

Remember "Expected Value" (i.e. integral) is defined for a random variable (i.e. a function) not for a sequence. Thus it has to be the integral of the limit in this case, which is very similar to the example above. If you understand this example, you understand the problem, it's really no more complicated than this, despite the volume of discussion.

If you want a reference or authority that explicitly discusses this question I've linked some textbooks that discuss this problem exactly (find "367").

There's considerable discussion in this thread of whether it's hypothetically workable to somehow define the Expected Value in this situation in some different way than the standard way, and my position is no, but it's not really relevant to the answer, as Expected Value does in fact have a standard definition. The discussion petered out without a real proposal for a different definition being given (find for "up-for-grabs" for the thread).

Thinking about 0 * infinity isn't the most helpful way of thinking about this problem, but there's some interesting discussion on it in this thread. The upshot is that it is defined to be 0 in analysis books such as https://terrytao.wordpress.com/wp-content/uploads/2012/12/gsm-126-tao5-measure-book.pdf , and that the fact that the area of an infinite line is 0 and the integral from -infinity to infinity of 0 is 0 hinge on it, you can't define it otherwise without contradicting these facts.

Finally, on a purely intuitive level I had a comment (find "math contest") that I think may make you feel a bit better about the counterintuitive nature of this result.

With unlimited funds there is no gambler's ruin to stop the player from playing. Assuming the player is not just financially capable but also physically capable of playing the Martingale strategy to an arbitrary length of rounds then the expected value is the initial wager.

Since the player is using the Martingale System and has the arbitrary capacity to play it to it's completion the realized losses or gains of the strategy can and should be evaluated at the completion of that strategy, waiting, potentially an arbitrary number of rounds, for a single win.

@ShitakiIntaki I think the part I'm stuck on is how we justify ignoring the zero-probability event where Euclid's sequence of spins is {black, black, black, ...} forever (see FAQ5). We can't always ignore zero-probability events, so if we can here, we need to articulate why.

I think there's a measure theory rationale for ignoring it, but I believe that's what needs to be spelled out before we have a definitive answer here. And why is that measure theory thing better than taking a limit as Euclid's bankroll goes to infinity? Is it by conventional definition of "expected value"?

@Primer Sincere apologies that this market is still unresolved. I can't resolve it to either YES or NO without an expert consensus. Resolving N/A is also bad. Some commenters here are confident that the expert consensus is NO but that's not my impression from asking around so far.

In my defense regarding the year and counting that this has been open, I created it when Manifold solved the problem of long-term or open-ended markets by loaning people their invested mana back [UPDATE: true again now, yay!]. Also I explicitly set the end date to 2099 and warned everyone (even in the title) to bet with caution before we'd pinned down the rest of the resolution criteria. In any case, loans may be coming back [they did!], which would attenuate the urgency again on getting this resolved. If it turns out loans are not coming back, I intend to accelerate the resolution. I'm still very interested in the question and what the exact clarification about measure theory or whatever is needed to get an unambiguous answer here.

Let the change in bankroll on the nth round be denoted by W_n. That is, it will equal 2^n for a win, -2^n for a loss, and 0 if W_m =2^m for m < n.

Then, for a player with finite bankroll - say, enough funds to play at most N rounds, their wealth after playing will be equal to W_1 + W_2 + … + W_N. The expectation of each W_i is equal to 0, so by linearity of expectation, the expectation of the game is zero.

Now, in the infinite case the result of the game is equal to W_1 + W_2 + …, so by countable additivity the expectation of the game is 0 + 0 + … and so overall equal to 0.

To me this seems like the obvious way to set up the problem, and the answer follows immediately from it. Is there anything wrong with this?

@Waffloid Read my very first comment on this question, EV is linear over an infinite sum under some conditions that are not met in this case. (The relevant conditions are the bounded and monotone convergence theorems, same situation here)

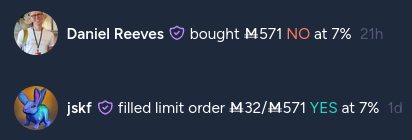

@dreev could you help me cash out so I can donate? I made a limit order to sell all my NO shares at the current market price.

@dreev if you intended to fill my order you got the amount wrong. I have 7691 remaining NO shares to sell, which would cost around 7k mana (but since you have a YES position the shares would immediately be redeemed).

@jskf Sorry to be a tease there! I was just like, "sure, trivial amount of money, no problem" without noticing that that was only a fraction of your limit order. In the meantime, it looks like there's a better way for people to donate the expected value of their positions:

If you're looking to donate over M10k, apply for a loan from Manifold so that you can donate the value of your shares immediately: https://forms.gle/XjegTMHf7oZVdLZF7

@Primer Is there a way to see the most anyone has tied up in a market? I expected everyone's mana to be loaned back by now.

@ShitakiIntaki Thanks! And nice work! Though I'm skeptical of the numbers. It shows me as having only an eighth of what I've spent in this market loaned back to me? I collect my mana loan almost every day and it only takes something like 90 days to get over 90% loaned back, I thought...

@dreev mmm it is what ever the API is reporting as loaned.

for the moment https://api.manifold.markets/v0/bets?contractId=tBwjJKw0FDngm9guTrE6 returns 464 records, so I dont think there are issues with a truncated api response.

@dreev You're loaned back a percentage of the shares' worth, not a percentage of your initial spending.

@ShitakiIntaki Now I'm thinking there's just a problem in how we're interpreting "tied up". I think we want to think of that in expectation, using the current market price. Like it doesn't matter anymore what you spent; that's sunk cost. If you've been loaned back the current EV of your shares, you should have no preference for the market to resolve early. If you think your shares are worth more than the market's EV, that means you also don't want the market to resolve yet, because you want to trade more.